India’s stock market has emerged as one of the most dynamic and promising investment destinations globally. With its robust economic growth, young population, and rapidly expanding sectors, the Indian market presents attractive opportunities for American investors. This article explores the key factors driving American investment in the Indian stock market, the opportunities available, and the considerations to keep in mind.

Why Invest in the Indian Stock Market?

- Strong Economic Growth

India boasts one of the world’s fastest-growing major economies, with GDP growth rates often surpassing those of developed nations. This economic dynamism is driven by a large and youthful population, increasing consumer demand, and a burgeoning middle class. For investors, this growth translates into potential for high returns, as companies expand and new industries emerge. - Emerging Market Potential

As an emerging market, India offers substantial growth potential compared to more mature markets. With ongoing economic reforms, liberalization, and infrastructure development, India is positioned to attract significant foreign investment. Sectors such as technology, pharmaceuticals, renewable energy, and consumer goods are particularly promising. - Diverse Investment Opportunities

The Indian stock market provides a diverse range of investment options. Investors can choose from large-cap companies with established track records, mid-cap and small-cap stocks with high growth potential, and sector-specific investments. Additionally, India’s capital markets are becoming increasingly sophisticated, with a growing number of financial instruments and investment vehicles available. - Technological Advancements

India’s stock exchanges, such as the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), have adopted advanced technology platforms, improving market efficiency and accessibility. These advancements make it easier for international investors to trade and manage their investments in India.

Investment Avenues for Americans

- Direct Investment in Indian Stocks

American investors can directly invest in Indian stocks by opening an account with an Indian brokerage firm. This approach requires compliance with regulations set by the Securities and Exchange Board of India (SEBI) and the Foreign Exchange Management Act (FEMA). Direct investment offers the advantage of accessing a broad spectrum of Indian companies and sectors. - Mutual Funds and Exchange-Traded Funds (ETFs)

Investing in mutual funds and ETFs that focus on Indian markets provides a more convenient way for American investors to gain exposure to Indian equities. These funds are managed by professionals who are well-versed in the local market conditions and can offer diversified exposure to Indian stocks. Some funds are specifically designed for international investors, simplifying the investment process. - American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs)

ADRs and GDRs are financial instruments that represent shares of Indian companies traded on U.S. stock exchanges. These instruments allow American investors to invest in Indian companies without directly dealing with the Indian stock market. ADRs and GDRs provide a convenient way to access Indian equity markets while trading in U.S. dollars. - India-Focused Investment Vehicles

Several investment vehicles are tailored for international investors seeking exposure to Indian markets. These include sector-specific funds, thematic investments, and private equity opportunities focused on high-growth areas within India. These vehicles offer targeted exposure and can align with specific investment strategies.

Considerations for American Investors

- Regulatory Environment

Understanding the regulatory framework is crucial for investing in the Indian stock market. American investors must comply with SEBI regulations and FEMA guidelines, which govern foreign investments in India. Working with reputable financial advisors and brokers familiar with Indian regulations can help navigate these complexities. - Currency Risk

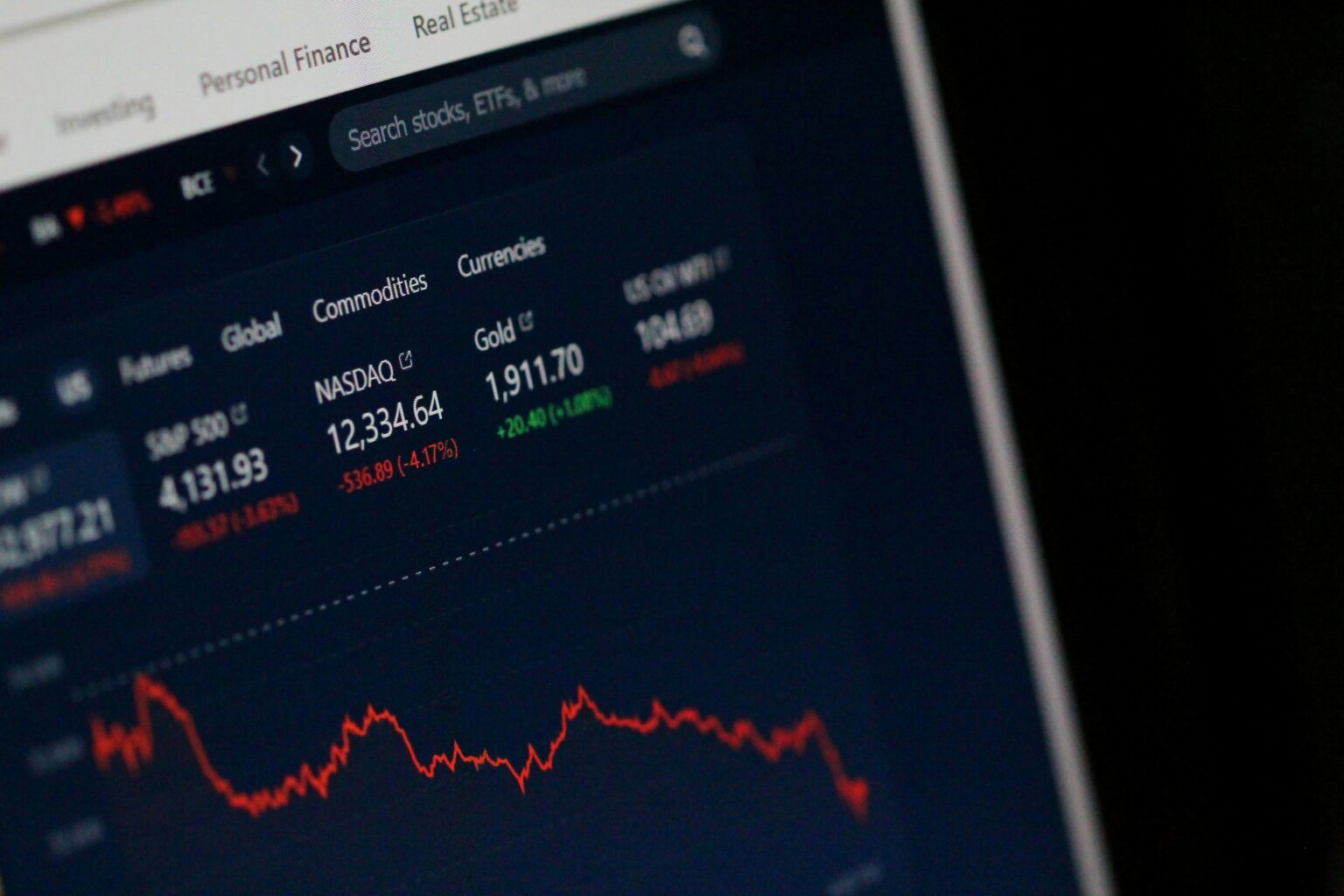

Investing in Indian stocks involves exposure to currency risk, as fluctuations in the Indian rupee can impact investment returns. Investors should consider strategies to manage currency risk, such as hedging or diversifying their portfolios across different currencies and markets. - Market Volatility

Emerging markets, including India, can experience higher volatility compared to developed markets. Investors should be prepared for market fluctuations and adopt a long-term investment perspective to mitigate the impact of short-term volatility. - Economic and Political Factors

India’s economic and political landscape can influence market performance. Factors such as government policies, economic reforms, and geopolitical developments can impact investment outcomes. Staying informed about local market conditions and macroeconomic trends is essential for making informed investment decisions.

Conclusion

The Indian stock market offers a wealth of opportunities for American investors seeking to diversify their portfolios and tap into one of the world’s fastest-growing economies. With its strong economic growth, diverse investment options, and advanced market infrastructure, India presents a compelling case for investment. By carefully considering regulatory requirements, managing currency and market risks, and staying informed about local developments, American investors can unlock significant potential in India’s vibrant stock market. As India continues to evolve and expand, it promises to be a key player in the global investment landscape, offering rewarding opportunities for those willing to explore its dynamic market.

If you’re interested in more Indian American Business News click here!